Insight

ESG and sustainability: what information should you monitor and report?

How to decide your strategy and approach

Environment, social, and governance (ESG) and sustainability regulation is growing, particularly in the EU. Beyond mandatory rules, there are also broader standards and non-mandatory recommendations that organisations need to consider.

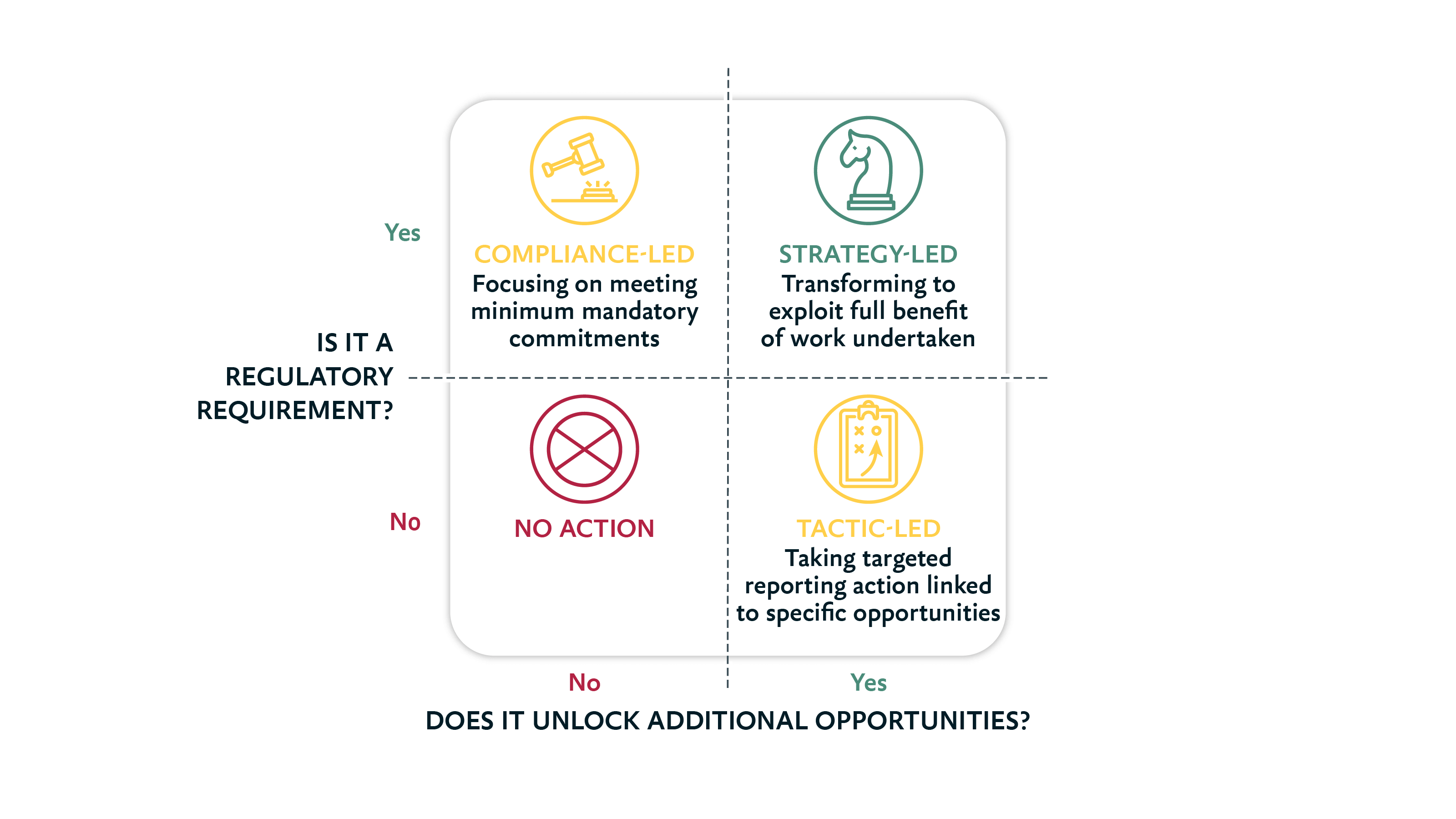

How do leaders decide what ESG and sustainability information their organisations should monitor and report? They should keep this key principle in mind: the right strategy and approach will mitigate threats and unlock additional opportunities.

A simple decision-making guide for ESG and sustainability monitoring and reporting

The compliance-led approach to ESG and sustainability

Meeting mandatory commitments is a given, and all organisations will need to focus on compliance at bare minimum. Avoiding potential penalties or sanctions is a business benefit in and of itself.

This approach is also essential for keeping in line with competitors, and for maintaining brand reputation among stakeholders and customers.

The strategy-led approach to ESG and sustainability

Some regulatory requirements will lead to additional business opportunities. For example, monitoring and reporting emissions data could help businesses better attract and retain employees, who are increasingly concerned over climate change, or develop stronger, more purpose-led relationships with their customers.

Strategic-minded leaders will consider how they can exploit the full benefit of the monitoring and reporting work their organisations are required to undertake. This could require transforming aspects of the business or even the organisation as a whole, including building the right functions and capabilities.

The tactic-led approach to ESG and sustainability

Many organisations will find it’s worth monitoring and reporting wider information, even though it may be non-mandatory. Organisations may wish to abide by broader reporting standards depending on:

- What is material to them

- The degree to which a standard aligns to the regulation that is applicable to them

- The degree to which a standard resonates within certain regions, countries or supply chains, or with employees and other stakeholders

- Their ability to unlock specific opportunities depending on the industry they operate within.

The extent to which an organisation should go ‘above and beyond’ will depend on the benefits that can be achieved. This tactic-led approach will usually mean taking targeted reporting action linked to specific opportunities.

The best ESG and sustainability reporting is always outcomes-focused

Where there is no regulatory requirement, and no additional benefits to be gained, organisations should take no action on reporting. Time and effort can be better spent elsewhere for greater impact.

Even then, organisations still need to maintain an effective monitoring mechanism over reporting. Legislative, industry and market factors can change rapidly and organisations may need to take different actions in the future.

Of course, there is always still a strong case for doing more on sustainability – even if you don’t have to report on it.

By making conscious choices, leaders can link each regulation and standard to meaningful outcomes for their own organisation. They can then ensure their ultimate focus remains on the pursuit of those outcomes, rather than reporting as an end to itself.