In part one of this two-part series on strategic portfolio management, we discussed the key priorities that a management function should focus on. In part two, we take a look at how to deliver a change portfolio successfully.

How to take a smarter, more agile approach to portfolio management

Many change portfolio functions require a real change in emphasis if they’re to deliver their priorities successfully and efficiently.

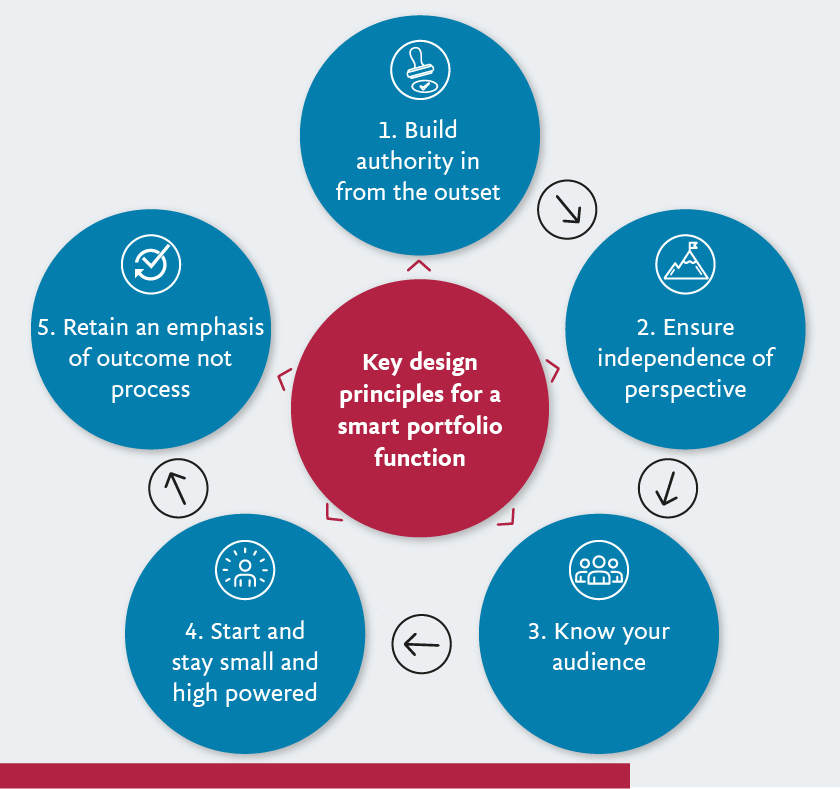

There are a range of demands on how a change portfolio operation needs to function, and how it operates within the wider organisational context. There are many factors to consider, and local circumstance will likely drive focus in particular areas, but the following principles are core to driving success.

1. Build authority into a change portfolio function from the outset

To be successful, a portfolio function needs to be sponsored and supported top down. It needs to be seen as the engine of portfolio change for the senior management team – and be able to speak and act with this authority.

If done well, this gives the portfolio management function the remit it needs to operate effectively. However, this means the senior management team needs to really understand the portfolio operation’s value and its function.

2. Ensure a change portfolio function’s independence of perspective

So much of the activity of a portfolio management function is predicated on it being able to say it as it is, call out the difficult messages, and break through embedded positions. Its effectiveness is curtailed as soon as it’s seen not 'walking the talk' on independence.

It’s important therefore to think hard about where the function sits in the organisation, both in regard to functions and business units. Placing the function outside of the line accountability of directors who are also sponsoring material parts of the portfolio is important; equally, avoiding the risk of the function being seen as a mouthpiece for IT or for finance is desirable. Compromises need to be made here but this independence check is key to success.

3. A portfolio management function needs to know its audience

How a portfolio capability is implemented, how it engages with its stakeholders up and across the organisation and how it operates in the day to day should all be coloured by the culture it’s operating within. This is true for most functions but particularly so here. It’s these cultural norms that are at the heart of how organisations deliver change best.

Getting this wrong will doom a portfolio function to pushing on closed doors and needlessly antagonising. However, understanding the organisation's approach to risk and failure, its attitude to process, its historic experience of change, and how stakeholders are motivated to deliver will all help engage with and drive forward the organisation most effectively.

4. A change portfolio function should start and stay small and high powered

Keep the change portfolio team small and high powered – you don’t need a standing army to make a big difference. A portfolio management function should do a few vital things very well – at least to start with before it earns the right to expand remit.

Our experience shows that resourcing a portfolio management team with a small number of experienced, pragmatic individuals, who balance understanding of how to deliver change with knowledge of the organisation, keeps the function lean and effective. It also signals to the organisation that efficiency is an important factor both to the function and the portfolio as a whole.

Likewise, the portfolio management team must have credibility with stakeholders from the start, and the combination of soft and hard skills to deal with senior sponsors through to programme delivery teams.

5. A portfolio management function needs to focus on outcome, not process

Too many change portfolio functions become a slave to process and inadvertently lumber the organisation with this, quickly creating a low value industry that distracts from the delivery at hand.

Deliberately placing outcomes at the centre of the function’s remit helps avoid this (as does the size of the team). Clarity of delivery does not come from tomes of status.

Likewise, timely management of risk does not come from endless risks logs but from well managed discussion and clear accountability. Experience pays here, as does setting up the team with the confidence to remain flexible, to respond to feedback and change approaches that don’t work, and to push ahead with those that do.

Managing complex change at scale will always be hard and time consuming. Given the scale of investment, it will always be filled with risk. However, putting in place a more strategic portfolio management capability – one that drives outcomes for senior management and operates more smartly on the ground – will maximise the ability of an organisation to manage these risks and deliver lasting change.