A leading global energy major had embarked on an ambitious multi-year initiative to transform the operations of its North American gas trading business. After the successful completion of a business pilot, our client sought assurance that the critical strategic release was set up for success.

We were asked by the CIO of the global trading business to conduct a thorough programme assurance review, and to provide pragmatic advice and if necessary, suggest interventions.

Apart from their broad understanding of and experience in such projects, the real differentiator is that they integrate seamlessly and rapidly into our team and find a way to combine the best from all. This was another great example of a true collaborative experience with Berkeley, with the result that we were confident to make a major shift in strategy in difficult circumstances.”

COO, Global Gas Trading

A programme in unexpected trouble

The geographically dispersed team of over 150, was delivering streamlined business processes and a new bespoke pipeline scheduling and settlement solution for its US and Canadian operations. The business pilot had been successful but was small-scale in nature and delivered locally. As a result, the pilot did not reflect the complex environment in which the strategic releases would need be implemented. The scale of the full challenge had been significantly underestimated.

Business stakeholder confidence began to falter as several key milestones were missed, the schedule lengthened, and financial projections escalated. Team morale was low as the team had been working under significant pressure for some time and there had been some high impact resignations.

Getting to the heart of the problem quickly

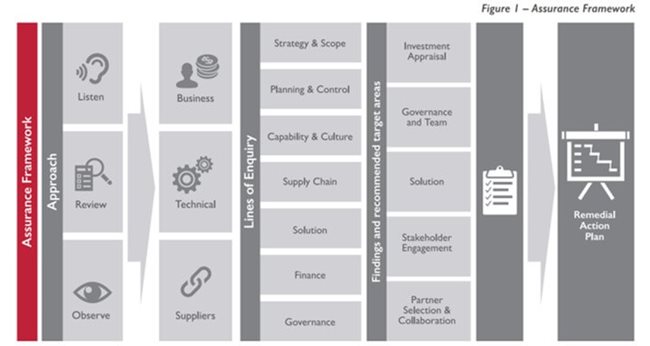

A small Berkeley team was on-boarded to work with the client programme manager as part of a focused review team. The Berkeley team applied an assurance framework (see Figure 1) which uses a combination of desktop review, interviews and observation.

A real differentiator, however, was the deep and relevant experience of the Berkeley team: one partner and one consultant who between them brought 30 years’ delivery experience to the assignment. This enabled us to immediately connect with, and win the confidence of, a team under some stress.

A ‘360 degree’ mix of internal business and technical stakeholders were engaged directly, together with a number of external stakeholders and third parties. These diverse perspectives helped us to rapidly form a considered and insightful position.

Within two weeks, detailed findings and actionable recommendations were presented to the senior business and IT executive team.

This was one of those assignments where the review revealed some significant and fundamental challenges. Working closely with the client we were able to help chart a new course and set things up for success”

Partner

Working hard with the client not just auditing them!

We tried hard to integrate seamlessly into the client organisation, and this approach facilitated the open and transparent discussions necessary for a genuine ‘deep dive’ into the programme. The trust that was established enabled sensitive and challenging questions to be posed.

The review precipitated a fundamental re-assessment of programme objectives and relative investment priority. Significant sums had already been spent without the intended outcomes being achieved. Drawing a line under this phase of the programme and charting a confident way forward was critical to restore confidence within the executive team and the wider business.

Supporting a fundamental change in direction

The review identified ‘root cause’ problems with programme governance and team leadership. These in turn led to issues with the programme business case, solution design, technology approach and supplier management.

Unfortunately, the problems were quite systemic and far-reaching, and a fundamental change of direction was required. We proposed a fairly radical shift towards a ‘buy’ rather than ‘build’ strategy, supplemented by a programme of targeted shorter-term investments in the existing system estate.

Our inclusive and pragmatic approach helped the client stay fully in control as it navigated through a difficult and challenging period. As a result, the executive team were able to embrace and own the new investment strategy.

This timely intervention helped the client avoid significant financial exposure while safeguarding the delivery of critical capability underpinning this dynamic and growing business.