Delivering change at scale will always be difficult, but better portfolio management can maximize the long-term value of change and reduce delivery risk. In part one of this two-part series on strategic portfolio management, we discuss what you need to prioritize.

What is portfolio management?

Portfolio management is a powerful tool for senior leadership teams, enabling them to prioritize, coordinate and control interconnected change programmes to deliver in support of strategy. Done well, it can drive forward change in an integrated and transparent manner, ensuring effective use of scarce resources and minimizing risk.

However, realizing the value of a portfolio management capability is difficult to get right.

We often see portfolio management functions lost in the detail as opposed to driving out clarity. Delivery stakeholders frequently avoid them, rather than seeking them out for advice. They can end up increasing the burden of process, not removing it.

When done poorly, portfolio management can be counter-productive, all too easily adding complexity and cost and frustrating efforts to deliver change on the ground.

A more strategic portfolio management capability focuses on senior leadership’s required outcomes, operates more smartly on the ground, and better enables change at scale.

This requires re-prioritizing 'what' the management function should focus on and just as importantly re-assessing 'how' this function should deliver.

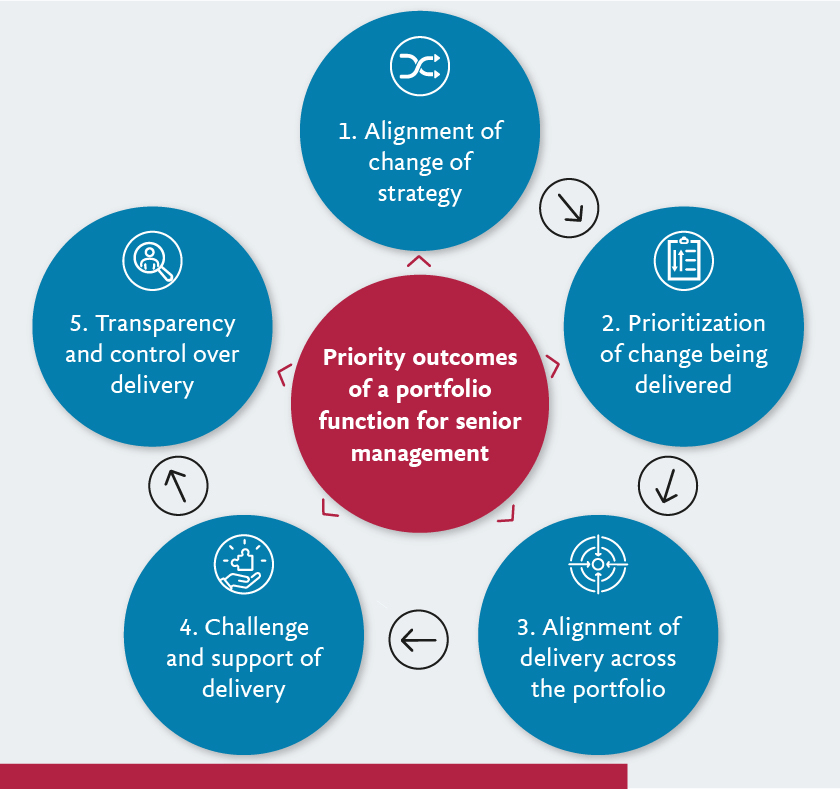

The ‘what’: focusing on key portfolio management outcomes

Any portfolio function has to 'earn its keep' fast by proving its value – critically to both senior management and also to delivery teams on the ground. Too often we see functions with a long list of responsibilities but with no clear prioritization of purpose.

In fact, prioritization is vital. It’s getting the big things right that really delivers value for the organization. Doing this well also earns the function the remit to do more.

What are these priorities? Combined, delivering the below form the basis of a high value portfolio management capability.

1. Aligning change to strategy: easy to say, hard to do

Core to a portfolio management function is building genuine management confidence that a change portfolio is driving delivery of business strategy. The function is there to practically bring to life the 'business case for change' at every level and ensuring hard conversations are had where needed, both initially and on an ongoing basis. This ongoing alignment should be at the heart of enabling the right level of executive discussion and challenge.

2. Prioritizing the change being delivered: not a one-off event

Scarce resource, whether it’s budget, people, technology, management time, supplier expertise or stakeholder capacity for change, makes managing a portfolio a tricky proposition. A good portfolio management function drives this on a continual basis.

It does this by bringing a rigor and openness to proceedings – minimizing the opportunity for discussions to become clouded in the politics that come with numerous stakeholders trying to push 'their' change through at all costs. Without it, and without the tension that this deliberately brings, change agendas quickly become bloated and unresponsive to pressures from above. A portfolio function is there to remove this risk.

3. Alignment of delivery across the portfolio: integrated where necessary

Broad-ranging portfolios of change often bring a challenge around interdependence. Most commonly, this takes the form of clashing delivery dates and their impact on programme plans.

However, a myriad of other less obvious interdependencies often lurks beneath the surface. A good portfolio function's job is to continually unearth these, make the connections and drive discussion to a point where there is confidence in an integrated plan.

Just as importantly, where this is not the case, the function should act as a catalyst to free change from the burden of being interdependent on others.

4. Challenging and supporting change delivery: good cop / bad cop

Projects are complex things to deliver and portfolios of projects more so; they need help and guidance to succeed. They also need to be clear that someone is monitoring them and holding them to account for delivery. Many portfolio functions don’t get this right, or don’t even try, but we believe it’s vital.

Providing both of these elements from one function may sound counter-intuitive but in our experience is hugely valuable. Providing value to projects – in the form of advice on how best to resolve resource or delivery conflicts, on how to escalate issues in the right way to minimize adverse reactions or on how to connect to other parts of the organization – is how a good function should be delivering for project teams. This helps 'open the door' to projects accepting as a matter of course that a good portfolio function should provide ongoing constructive challenge on status ('is everything really all green?!'), and on plans, benefits and costs.

5. Transparency and control: what senior management need above all else

It’s relatively easy to provide a veneer of control over how a portfolio of change initiatives is being delivered: pages of status reports with healthy looking traffic lights, detailed plan after plan, and status meetings galore.

There is no substitute for ‘whites of eyes’ discussions with those who are really accountable for delivering outcomes. Smart governance with the right attendance and facilitation can do this.

Well-structured transformation roadmaps focused on a small number of key milestones and interdependencies serve to bring the status of delivery up a level. This enables vital horizon scanning and informs management teams to make the timely course corrections needed. This is the heartland of what good portfolio management should be about.

Now that we know what a change portfolio management function should focus on, see part two for how it should deliver.