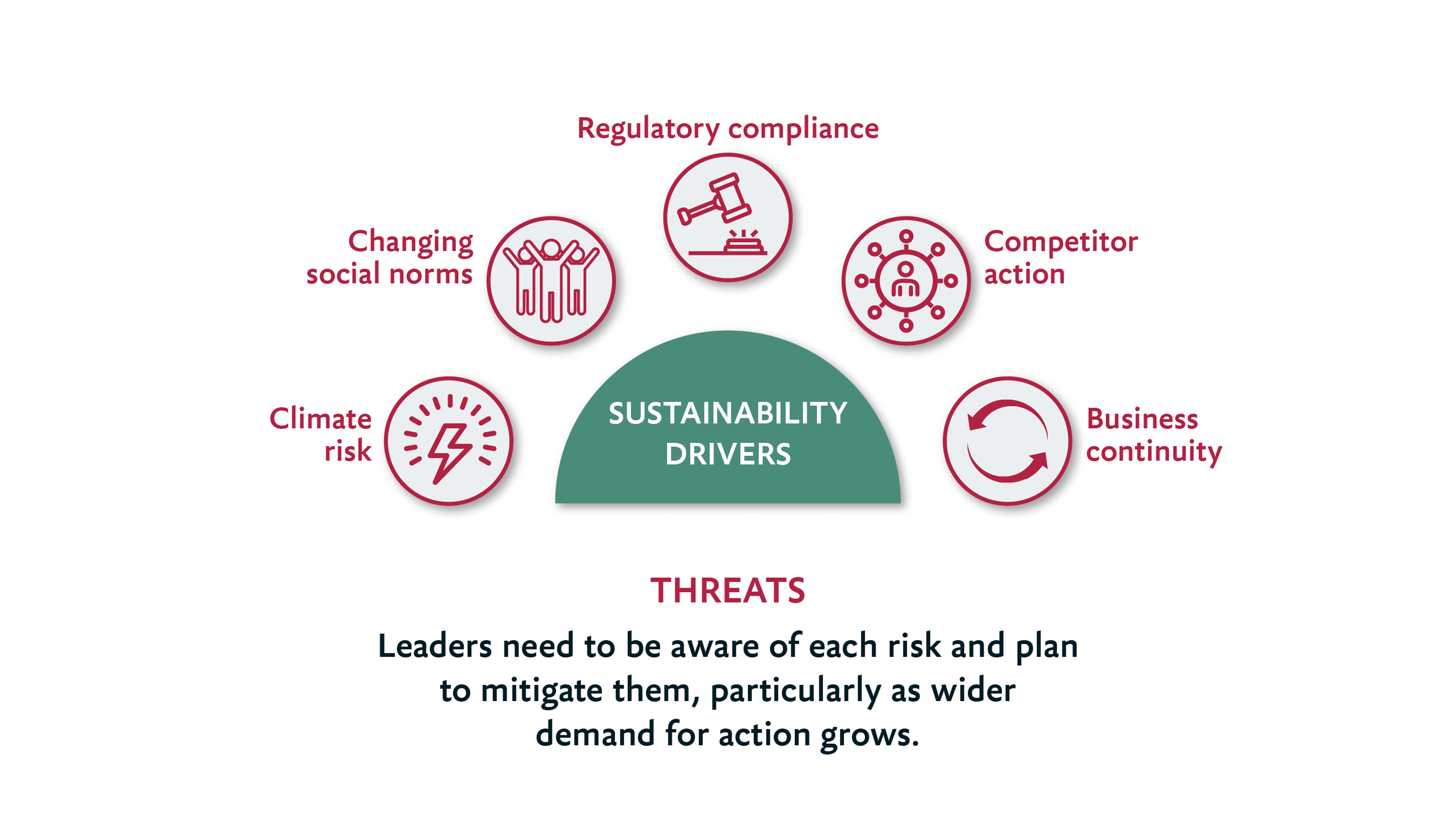

Consider the threats: are ESG and sustainability driving your business strategy?

ESG and sustainability are the right things to pursue from an ethical perspective. But many organizations have yet to reframe the imperative beyond that. There are tangible threats and opportunities now driving senior leaders to focus on ESG and sustainability as core components of their business strategy.

Here are the top five ESG and sustainability-related threats that business leaders need to assess and mitigate.

1. Climate risk

The science on climate change is now mainstream and compelling, with demonstrable examples of the adverse impact. This will have profound consequence for humanity, both directly e.g. food shortages, water shortages and property damage, and indirectly e.g. conflict and migration.

Keeping global temperature rises to 1.5C above the pre-industrial average can avert the most catastrophic climate impacts, including ‘acute’ one-off events e.g. major storms and droughts, and ‘chronic’ changes e.g. rising sea levels.

Organizations need to consider how such physical risks will impact their own operations and seek to mitigate them.

2. Shifting social norms

Societal values are changing, with greater demands for increased diversity, inclusivity, gender equality, and sustainability. Now making up around 50% of the workforce, millennials and Gen Z have greater knowledge of and exposure to ESG and sustainability issues.

Organizations are increasingly expected to work with integrity and to ethical and sustainable standards. There has been a 71% rise in online searches for sustainable goods globally over the past five years, for example.

The extended reach of social media allows individuals to quickly share their experiences and views with others, which places organizations under more scrutiny than ever before.

3. Regulatory compliance

New laws and regulations around ESG and sustainability continue to emerge. Organizations are increasingly required by law to disclose their non-financial information, such as net zero plans. They’re also further incentivized to publish ‘green’ reports, with a view that new standards will be introduced at a future point in time.

Climate-related litigation is also rising, with environmental and activist groups taking companies to court over their actions, including disclosure of incorrect or misleading information. The global cumulative number of climate-related litigation cases has more than doubled since 2015.

4. Competitor action

Mere compliance and ‘virtue-signalling’ is no longer enough. In the UK, for example, the Competition and Markets Authority has developed the Green Claims Code to address ‘greenwashing’, with plans to act against non-conformant companies.

The most forward-thinking organizations are using this as an opportunity to differentiate from their competitors. ESG and sustainability, supported by bold public targets and demonstrable action, can be used to strengthen brand reputation and unlock further opportunities.

5. Business continuity

To effectively manage all other threats, organisations need to build a capability for monitoring and mitigating risk, both in the immediate and long-term. This requires dedicated resource and buy-in; it isn’t something that happens automatically. If organisations haven’t considered how this relates to ESG and sustainability specifically, the lack of capability also becomes a risk in itself, threatening business continuity.

ESG and sustainability: the business opportunities

Organizations need to build the right level of agility to withstand emerging threats. However, the risks are only one half of the equation. The best approach to ESG and sustainability is not just about maintaining the status quo, but about unlocking and pursuing additional opportunities.

In part two, learn more about the top opportunities available.